Bank of America Premium Rewards Credit Card – 50,000 Point Bonus, $100 Annual Travel Credit

-

Annual fee of $95 (not waived first year)

$100 Airline Incidental Statement Credit annually for qualifying purchases such as seat upgrades, baggage fees, in-flight services and airline lounge fees. Only applies to domestic-originated flights on certain U.S. Domestic airline carriers.

$100 airport security statement credit towards TSA Pre✓ ® or Global Entry Application fee every four year

Sign up bonus of 50,000 points after $3,000 in purchases within the first 90 days of account opening

Card earns at the following rates:

2x points for every $1 spent on travel and dining purchases [Read: Best cards for dining purchases]

1.5x points for every $1 spent on all other purchases

No foreign transaction fees

Eligible for Bank of America Preferred Rewards, meaning you can get an additional 25-75% rewards on all purchases. Makes the card earn at the following rates with top tier status:

3.5x points per $1 spent on travel & dining purchases

2.625x points per $1 spent on all other purchases

Points are worth 1¢ each and can be redeemed for cash back as a statement credit into eligible Bank of America or Merrll Lynch accounts or to purchase travel through the Bank of America travel center or to redeem gift cards

-

This post is deleted!

-

I went ahead and picked this up after reading the FW thread and the reviews at https://thepointsguy.com/2017/09/credit-card-review-bank-of-america-premium-rewards/

With the BofA Preferred Rewards Platinum, this card earns 3.5x on Travel/Dining and 2.625x on everything else. That means I can sock drawer the Citi Double Cash and close the Chase Sapphire Preferred (+ transfer the credit limit) before the next Annual Fee.

-

The one reason you may not want to sockdrawer the Double Cash just yet is that the BOA card is a Visa (after all, Visa used to be called the BankAmericard). There are certain use cases like Plastiq where MC is accepted but not Visa. As for Chase Sapphire Preferred, just make sure you have another premium card to transfer points out of, should you use that option. I personally use Chase Ink because hitting Staples when they offer rebates on Visa/MC/Amex GC pays for my membership fee, but that option of a 5X premium card is no longer available.

-

Thanks, but I’m not worried about not carrying a MC. It’s been years since I’ve encountered a place that takes MC and not Visa. FYI, I took a quick peek at Plastiq.com and there’s a Visa logo on the front page so maybe they’ve added it recently.

-

Happy to see that my last useful post from FWF was reproduced here as one of the first finance posts. thanks @marcopolomle !

-

@meed18 said in Bank of America Premium Rewards Credit Card – 50,000 Point Bonus, $100 Annual Travel Credit:

Happy to see that my last useful post from FWF was reproduced here as one of the first finance posts. thanks @marcopolomle !

Thanks meed18

I’m just trying to keep the discussion continue here once the FW is shut down.

-

I have a bunch of other BofA Business and Consumer credit cards. Is this an easy card to apply and get approved?

-

Looking for input from people who have gotten this card or the other BofA travel card that had rewards tied to the preferred status.

- So if I going to get this credit card, should I open the credit card first and then open the Merill account? Or vice-versa or it doesn’t matter.

- So let us say I get the process rolling for both the credit card and the Merill account within the 1st week of Jan. Since I would not have completed a quarter, would I be earning the lower credit card benefit until a quarter is completed? Once the quarter is completed and then I have an average balance exceeding 100K, would I then start earning higher rate on the credit card rewards?

[I am going to be paying a estimated tax bill on Jan 15 to IRS. Trying to see if I can get the 2.625 points for transaction done by Jan 15].

-

This post is deleted!

-

The points you accumulate will get the bonus points from the platinum honors rewards as you redeem them, so wait until AFTER the 3 months to redeem any points accumulated…that way you will get the full benefit on the points you got before you qualified…

I have Platinum Honors with the BofA Cash Rewards Credit Card…so, that’s how i know…lol,

I waited until AFTER i qualified for Honors before cashing out points, at which point (when i did) i got the 75% boost automatically on them…

-

@craig10x

I’d get the credit card first then open the Merrill Edge and make sure they link up the BofA side to the Merrill Edge side…

-

From the credit card terms, " The value of this reward may constitute taxable income to you. You may be issued an Internal Revenue Service Form 1099 (or other appropriate form) that reflects the value of such reward. Please consult your tax advisor, as neither we, nor our affiliates, provide tax advice."

Geez - if they issue a 1099, then it makes it a taxable income. If they didn’t issue a 1099, then I understand it would be up to the individual to decide how to do their taxes.

-

@craig10x said in Bank of America Premium Rewards Credit Card – 50,000 Point Bonus, $100 Annual Travel Credit:

The points you accumulate will get the bonus points from the platinum honors rewards as you redeem them, so wait until AFTER the 3 months to redeem any points accumulated…that way you will get the full benefit on the points you got before you qualified…

I have Platinum Honors with the BofA Cash Rewards Credit Card…so, that’s how i know…lol,

I waited until AFTER i qualified for Honors before cashing out points, at which point (when i did) i got the 75% boost automatically on them…Actually, for this card, the bonus points are awarded while they’re earned, not redeemed. Here’s my month 2 statement showing the standard Rewards, the Preferred Banking bonus, and the 50k sign up bonus.

Your Reward Summary

1,823.92 - 2 Points/$1 on Travel&Dining

3,122.75 - 1.5 Points/$1 on All Other

3,711.26 - Preferred/Banking Rwds Bonus All Other

50,000.00 - Other Bonus This Month Other

65,396.69 - Total Points Available Month Other

-

@jcantanixon said in Bank of America Premium Rewards Credit Card – 50,000 Point Bonus, $100 Annual Travel Credit:

@craig10x said in Bank of America Premium Rewards Credit Card – 50,000 Point Bonus, $100 Annual Travel Credit:

The points you accumulate will get the bonus points from the platinum honors rewards as you redeem them, so wait until AFTER the 3 months to redeem any points accumulated…that way you will get the full benefit on the points you got before you qualified…

I have Platinum Honors with the BofA Cash Rewards Credit Card…so, that’s how i know…lol,

I waited until AFTER i qualified for Honors before cashing out points, at which point (when i did) i got the 75% boost automatically on them…Actually, for this card, the bonus points are awarded while they’re earned, not redeemed. Here’s my month 2 statement showing the standard Rewards, the Preferred Banking bonus, and the 50k sign up bonus.

Your Reward Summary

1,823.92 - 2 Points/$1 on Travel&Dining

3,122.75 - 1.5 Points/$1 on All Other

3,711.26 - Preferred/Banking Rwds Bonus All Other

50,000.00 - Other Bonus This Month Other

65,396.69 - Total Points Available Month OtherThank you - given that you have posted the numbers, I am going to believe you more. Definitely a no-no for me to pay the federal estimated with this card by Jan 15 - not enough time to qualify for the preferred status.

-

Unless this card is set up totally different than the standard card i can tell you for a fact that you don’t get the bonus honors points until the points are redeemed…that is exactly how it worked for me with the standard cash rewards card and i DID get the 75% points booster on all the points i had prior to qualifying for the honors rewards program! I even got it on the bonus points i received for OPENING the credit card account…If i were you, i’d call them to be sure…

-

@craig10x said in Bank of America Premium Rewards Credit Card – 50,000 Point Bonus, $100 Annual Travel Credit:

Unless this card is set up totally different than the standard card …

So looks like you don’t have this specific card. Given the numbers shared, it does look like the card is setup differently. I will call them and verify - still time before Jan 15 estimated tax deadline.

-

Just to add a couple of details, I qualified for the highest bonus level at ML before I opened this credit card. Also, unlike the cash rewards card, it doesn’t appear that any bonus percentage was added to the 50k point sign up bonus.

-

Wow these guys are so incompetent. So I open a Merrill account and it took them about 25 days to open the account. Granted it was a trust account - but 25 days? On top of it, even I opened the account, I asked for option privileges and none of that was setup. Personally, the little extra reward from them does not justify dealing with this kind of incompetence.

And on the credit card, got my 1st statement. Either I am missing something or they don’t allow it - I wanted to pay from an external account and I don’t see that option. Additionally, I don’t see an option to pay my bill in full every month from an external account. If that is all true, then those are big limitations of the card too. I like to keep my life simple - want things such as payments to happen automatically from my external account.

At this point, I will get my card sign on bonus and both Merrill edge and the credit card will be sock drawered.

-

The navigation on the BofA site isn’t great, but you can definitely use it to pay your bill from another bank account. I use Chase. You can also set up the automatic payments you mentioned. I’ll log in and take screenshots when I get a chance.

-

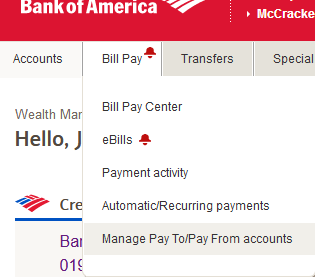

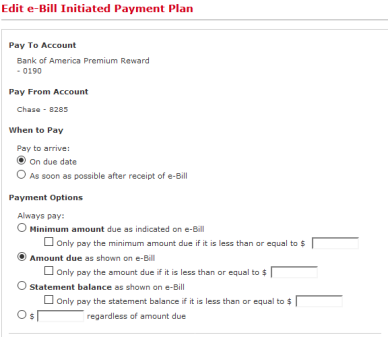

Okay, so both options you’re looking for are under Bill Pay.

To add external accounts, go to the Manage Pay To/Pay from accounts page. It’s pretty straightforward from there. Routing, account number, etc.

To auto pay your bill in full each month, Bill Pay Center. Then under that account, enable eBills if you haven’t already. You might be able to select your payment options during that. If not, go back to Bill Pay, Automatic/Recurring payments. Then choose edit and you should be able to set your auto payment for full each month like this.

Hope that helps.

-

I am like you @PrincipalMember and like to automate my bill payments.

Great job @jcantanixon with such a nice tutorial

I would like to add the warning - keep paying manually till the eBill initiated payment kicks-in which takes at least one statement cycle otherwise you will be slapped with various fees.

Once I set up eBill initiated payment and miscalculated the statement cycle dates and I was slapped with Late fee as well as interest.

Also, business cards do show up under BoA account but there is no option of eBill initiated payment. I had to do it manually every time for Alaska Business Card.

With BoA cards I just sock drawer them after getting the bonus.

-

Thank you very much jcantanixon! I would have never figured this out on my own.

-

In case anyone who wasn’t previously a BOA customer or didn’t already satisfy the Preferred Rewards average balance requirement is looking at getting this card, you’re likely going to have to wait to qualify for status. I know it requires a BOA checking account and looks at the combined balances of your BOA and Merrill Edge accounts, but it looks like they use the 3-month rolling average to not only determine the ability to maintain status, but also for initial qualification. Said another way, you need to wait (up to) 3 months before joining the program.

From what they’ve told me, you cannot qualify based on a current balance level, and then keep the 3-month balance to maintain your status – as noted in some other threads, they only re-qualify you annually, so once you’re in, you’re good for a year. That’s great once you are in, but it really makes no sense to get new customers.

For example, since Capital One is getting out of online brokerage (and I don’t want to be transferred to E-Trade), I decided to move my accounts to Merrill Edge. Since I was moved > $100K to ML, I thought i would give BOA a try too since I’ve never been thrilled with Chase over the last 20+ years. This credit card and the 50k point offer was presented when I submitted the banking application, so I figured why not…

Unfortunately, I can’t avoid the non-BOA ATM fees, get the extra points, etc. until I qualify for Preferred Rewards, so that basically means I have to have the account open and wait 3 months until I can really start using it since I usually hit a non-home bank ATM a couple of times a month.

From what they’ve told me, I have to wait until April (3 months after opening the account). Which from a marketing new customer perspective gets a D- grade from me.

Yes, I know what an average balance is (and how to calculate it), but the few bank programs I’ve participated in always used those to maintain status, and allowed participation by initial qualification.

-

@high-technology said in Bank of America Premium Rewards Credit Card – 50,000 Point Bonus, $100 Annual Travel Credit:

For example, since Capital One is getting out of online brokerage (and I don’t want to be transferred to E-Trade), I decided to move my accounts to Merrill Edge. Since I was moved > $100K to ML, I thought i would give BOA a try too since I’ve never been thrilled with Chase over the last 20+ years. This credit card and the 50k point offer was presented when I submitted the banking application, so I figured why not…

Unfortunately, I can’t avoid the non-BOA ATM fees, get the extra points, etc. until I qualify for Preferred Rewards, so that basically means I have to have the account open and wait 3 months until I can really start using it since I usually hit a non-home bank ATM a couple of times a month.

I was an existing BofA customer (w/ a checking acct) when I opened up an ME acct in Dec 2017. I moved in > $200K to ME in mid December, 2017 (due to the $1K sign-up bonus that was being offered for moving in a balance of that size).

A little over a month later (near the end of Jan 2018) I automatically qualified for BoA Rewards Platinum status (i.e. the 2nd highest tier which gives you one free foreign ATM transaction per month). A few weeks later (by mid Feb 2018) I qualified for Platinum Honors Status (the highest tier). In total, I ended up having to wait a little over a month and a half to reach the maximum status level.

I agree w/ your point that it’s silly of BofA to make customers wait to reach that level if they’re bringing in such high amount. Am still waiting for the $1K sign-up bonus @ ME.

-

Thanks, that’s really good to know. Since I wasn’t an existing banking customer, i guess I will have to wait/see how they do it for me (since instead of a 3 month history, I will only have one month).

In your case they had a history, so your first month statement close after the deposit bumped you up, and I am hoping mine will too, at least partially (even if they average in two months of zero and one month of my balance, I should qualify for one of the higher tiers — though technically an average should phase in when there is no prior data).

-

@high-technology said in Bank of America Premium Rewards Credit Card – 50,000 Point Bonus, $100 Annual Travel Credit:

In your case they had a history, so your first month statement close after the deposit bumped you up …

That’s very much possible; however, given that the first level I reached was Platinum (near the end of Jan 2018), and few weeks later Platinum Honors (in mid Feb 2018), I don’t get why I didn’t become eligible for some of the lower levels earlier on in Jan 2018.

-

No joy for me yet. It’s been more than 30 days, both my BOA and ME accounts posted statements a week ago and still says ineligible. I called ML and they got someone from the rewards group on the line who told me I would have to wait three months from account opening regardless of my balances and whether 1/3 of my balance after one month would meet the threshold the top tier.

So a great package once you have it, BUT TERRIBLY DESIGNED TO BE USED AS A MARKETING TOOL to attract new, high net worth customers. I will use the card for travel to meet the spending threshold hefore the 90 days are up to lock in the card bonus and I will use it much more once the qualification for Platinum clears.

-

Another monthly statement closed, and within a couple of days I’ve been qualified for the Platinum Honors. So I signed up, and my future charges starting the following day started earning the extra bonus percentage of 75%.

It’s still not clear to me how the determine eligibility, but I am guessing they needed a second monthly statement. My one month average balance / 3 would still qualify me so I have no idea how the determined eligibility.