Difference between Savings account return and CD

-

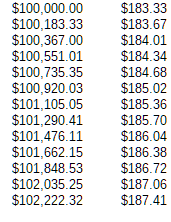

I readily admit I’m not the smartest person AND I’ve attempted to research the question. Please be gentle. In any case…a person wants to compare how much interest would be earned/paid when comparing a Savings Account vs 1 yr CD. Say a Savings Account shows 2.2% vs. High-Yield 1 yr CD of 2.75%. Both compound daily yet the CD only pays the interest at the end of the term and the Savings Account credits/deposits the earnings monthly. Presume money won’t be needed for the term of the CD so gut response would be buy CD for higher yield. However, I feel the compounding effect of the Savings account, each month increasing balance, would reduce the benefit of the slightly increased interest rate. I’ve attempted to find a formula to compare but have been unable to do so. Perhaps I’m not seeing how to look at this but really I’ve tried. Even broke out the spreadsheet and played. Thoughts?

-

Wouldn’t they both compound? I thought the only thing was there’s a chance of the savings account rate to go up or down, but with a CD you’re locked in.

-

I just sort of figured out the formula and created a really simply spreadsheet and it looks even with adding the prior months Interest into the principal and compute the next month interest on increased balance it still is less at the end of 12 months than the CD. I guess I needed a reminder of the definition of “APR”

-

You’re probably looking at Ally. Both rates are already APY, not APR. If you take the APY and divide it by 12 for your monthly interest computation, that’s wrong.

https://www.investopedia.com/personal-finance/apr-apy-bank-hopes-cant-tell-difference/