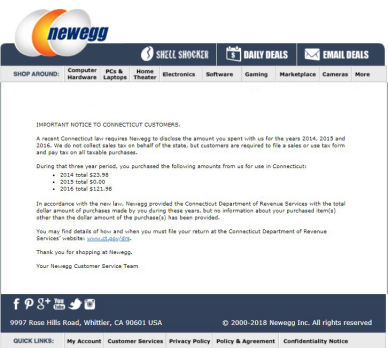

Just Got This Wonderful Love Note from Newegg!

-

Live in Connecticut? Bought anything from Newegg in the past four years?

Congratulations! You can look forward to a nastygram from the Department of Revenue Services, along with a bill for Sales & Use Tax for all of your Newegg purchases going back to 2014.

Plus interest and penalties, of course.

That’s not a worst-case scenario. They may very well use this information as a starting point…after all, if you bought from Newegg, you probably made other online purchases, too…so the sky’s the limit. They might decide to audit you and demand you bring your credit card statements.

Thanks, Newegg! You’re awesome!

-

What is this world coming to?

-

This makes CT look desperate.

-

@frugalfreak They are. Connecticut has a long history of shenanigans like this. I remember 25 or 30 years ago, they came out with a marijuana tax stamp, hoping that drug dealers would fill out the forms and pay taxes on their weed sales. Really.

But what’s shocking is Newegg’s behavior. They are a California corporation and Connecticut’s Department of Revenue Circuses has no enforcement authority over them whatsoever.

If they decided to start collecting Connecticut sales tax, fine. But to hand over their customer list and sales totals to a government agency for what can only be strong-arm collection and audit purposes? Unbelievable.

And you can bet, every other state (except New Hampshire) will be watching the outcome very carefully. Easy money.

-

One of the richest states (household income average) and second most taxed state in US. But yet this state has seriously gone downhill over the years. The only thing that made me happy was the medical weed. You need it here. Kinda helps you forget the other bullshit.

-

@ctcarl said

I remember 25 or 30 years ago, they came out with a marijuana tax stamp, hoping that drug dealers would fill out the forms and pay taxes on their weed sales. Really.That wasn’t so they would pay, but when arrested they could use the tax law to confiscate cash and an additional charge for not paying. AL had it too

http://norml.org/legal/item/alabama-tax-stamps

"Penalty for Nonpayment (Civil and Criminal ) 200% of Tax Class C Felony"

-

Wow. Is this just for Connecticut for now? Luckily I buy nest to nothing at New Egg. I sure hope Amazon doesn’t pull something like this though.

-

@mrvietnam So far as I know.

But once CT starts bragging about how much revenue was brought in, who knows? It’s not like Newegg is likely to say, “Well, okay, we screwed over our Connecticut customers, but [insert random state here]? Never!”

-

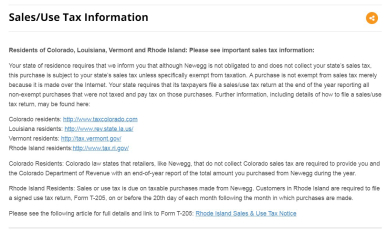

This just in from the Department of Well, That Didn’t Take Long…

Colorado, Louisiana, Vermont, and Rhode Island are next:

https://blog.taxjar.com/use-tax-notification-law/

http://wpri.com/2017/01/19/heres-how-rhode-island-hopes-to-tax-online-purchases/

At least they were warned. Connecticut customers weren’t (and still aren’t). From Newegg’s Help section:

-

@ctcarl WTF customers in Rhode Island have to file a tax use form every month?

-

@dangeruss If I had to guess, I’d say that Newegg is taking part of RI’s Sales and Use Tax reporting requirements out of context.

It’s common to require retailers to report and remit sales taxes monthly, but to require individual taxpayers to do so seems like overreaching.

OTOH, if you had told me a few weeks ago that a retailer the size of Newegg was going to turn over historical customer data to an out-of-state government agency, when they knew that said agency had no power to compel them to do so, and it would almost certainly result in the retailer’s customers being taxed, penalized, and possibly audited , I would have said that seemed like overreaching too. Yet here we are.

-

@ctcarl BUH-BYE Newegg