Best Nationally Available High APY Liquid Accounts

-

Juno Finance (Evolve Bank & Trust)

was 5.00% up to $25,000, then 4.00%

now 5.00% up to $50,000, then 4.00%

-

Laurel Road High Yield Savings 4.80%

https://www.laurelroad.com/high-yield-savings-account/Note: They currently have a $200 bonus offer for opening a checking account which may be of interest. See website.

-

Marcus was 3.90%, now 4.15%

Medallion Bank (via Savebetter) was 4.82%, now 5.02%

CIT Platinum was 4.75%, now 4.85%

CIT Savings Connect was 4.50%, now 4.60%

-

Popular Direct Savings was 4.75% now 4.85%

Betterment was 4.35% now 4.50%

Idabel National Bank MM(via SaveBetter) was 4.35% now 4.45%

Dollar Savings Direct Savings was 3.50% now 4.00%

Zions Bank MM was 2.02% now 2.28%

-

@goldsheet said in Best Nationally Available High APY Liquid Accounts:

LAUNCHING IN 2023

We’re preparing a new, FDIC-insured, High-Yield Savings Account

with no minimum deposit and an industry-leading 4.50% APY,

exclusively for M1 Plus members. ($125 annual membership fee)

https://m1.com/save/high-yield-savings-accounts/I got an email from M1 today and I guess it’s because I signed up from this thread. Looks like they are launching at 5%, which is good, if there is really going to be a $125 annual membership fee as the post above says, then probably not worth it.

Exciting news,

Today is the first day of the M1 High-Yield Savings Account rollout. In the coming weeks, you’ll get an invitation to open your account. And we have a big update…

M1 Plus members get 5.00% APY1

All other clients get 1.50% APY1 on their balance. And with so much room for your savings to grow, we’ve taken extra steps to make sure your money is secure.

Savings accounts are now insured up to $5 million3. You get 20x higher than the standard $250,000 FDIC insurance that other institutions offer.

It’s almost time…

Starting today, we’ll be sending out invites to open your account.

Keep an eye out for yours soon.

Learn more

Thanks for choosing M1,

The M1 Team

-

@mtnagel

M1 had better promotions last year.

I deposited $50K into INVEST (0.0%) to get a $500 bonus

When bonus was credited I moved $ to SPEND

SPEND was paying competitive rate and $125 fee was waived for one year.

Didn’t renew M1+ and emptied the account.

-

Total Direct Bank MM was 4.82% now 4.95%

Primis Bank Savings was 4.77% now 4.92%

Primis Bank Checking was 4.77% now 4.92%

Valley Direct Bank Savings was 4.20% now 4.50%

Ivy Bank Indexed Savings was 4.17% now removed from website

-

CIBC Bank Savings was 4.37% now 4.52%

Empower Personal Cash was 4.25% now 4.45%

FNBO Direct Savings was 3.40% now 3.75%

-

CFG Bank MM was 5.02% now 5.07%

Patriot Bank MM(via SaveBetter) was 4.80% now 5.02%

Great Lakes Credit Union MM(via SaveBetter) was 4.60% now 5.00%

Quontic Bank Savings was 4.05% now 4.25%

-

Discover AAII Savings was 3.80% now 3.95%

Discover Savings was 3.75% now 3.90%

American Express Savings was 3.75% now 3.90%

-

Ally Online Savings Account was 3.75%, now 3.85% (sad)

-

If you have money in Ally Savings, might as well move it to Money Market: 4.00% -> 4.15%.

-

My Banking Direct

Your High Yield Savings Account increased to 5.00% APY.

-

All America Bank MM was 4.80% now 5.05%

Redneck Bank MM was 4.80% now 5.05%

-

@jtownsucks46 said in Best Nationally Available High APY Liquid Accounts:

All America Bank MM was 4.80% now 5.05%

Redneck Bank MM was 4.80% now 5.05%They also increased maximum deposit from $75,000 to $100,000

(Already updated in table, but wanted to mention it here)

-

Total Direct was 4.95%, now 5.07%

America First CU (via savebetter) was 4.90%, now 5.03%

Salem Five was 4.61%, now 5.01%

Upgrade Premier was 4.56%, now 4.81%

Vanguard Cash Plus was 4.25%, now 4.50%

-

Vio Cornerstone was 4.85%, now 4.88%

-

NEW

5.25% APY on balances of at least $1k.

Minimum $2k balance is required to avoid a $10 monthly fee.

Brilliant Bank Luminary Money Market

(Nationally available except AR, KS, MO, and OK)

https://www.brilliant.bank

-

Ally Online Savings Account rate is increasing from 3.85% APY to 4.00% APY on 06/07/2023.

-

Dollar Savings Direct Savings was 4.00% now 5.00%

-

Cloud Bank 24/7(via SaveBetter) was 5.00% now 5.05%

Popular Direct Savings was 4.85% now 5.00%

iGo Banking MM was 4.75% now 4.85%

Lemmatta Savings Bank MM (via SaveBetter) was 4.55% now 5.03%

Valley Direct Savings was 4.50% now 4.85%

Bank Purely Index MM was 4.34% now 4.56%

iGo Banking Index MM was 4.34% now 4.56%

Communitywide Credit Union Monthly Savings was 4.25% now 4.50%

TIAA Bank Savings was 4.25% now 4.50%(guaranteed for 1 year)

TIAA Bank MM was 4.25% now 4.50%(guaranteed for 1 year)

Synchrony Bank Savings was 4.15% now 4.30%

Discover AAII Savings was 3.95% now 4.05%

Discover Savings was 3.90% now 4.00%

American Express Savings was 3.90% now 4.00%

Capital One Bank Savings was 3.75% now 4.00%

First Internet Bank MM was 3.56% now 3.66%

Self Help Credit Union MM was 2.82% now 2.96%

PenFed Credit Union Savings was 2.70% now 3.00%

Zions Bank MM was 2.28% now tiered rates: 1k-25k: 4.24%, 25k-100k: 4.34%, 100k+: 4.45%

-

FYI: We are excited to announce that by the end of June, SaveBetter’s name will officially change to Raisin

https://www.savebetter.com/blogs/introducing-raisin-your-secure-savings-marketplace

-

CFG Bank MM was 5.07% now 5.12%

Bask Bank Savings was 4.75% now 4.85%

-

Bread Savings was 4.65%, now 4.75%

-

Speaking of Bread Savings. I’m trying to move a chunk of money out of it and I see they have a $5k daily limit. Ugh. So I added it to my 5/3 account and tried to pull money from Bread, but I got an email from 5/3 that said, “The transfer you requested has been canceled because the service is not available for the selected accounts.” What does that mean?

-

Northpointe Bank is offering a bonus of up to $1,250 when you open a new Promotional Ultimate Savings

or Promotional Money Market account and maintain a qualifying balance for 3 months.

Bonuses are as follows:

Deposit and maintain $25,000 – $50,000 and get a $350 bonus (350/25000=1.40%)

Deposit and maintain $50,000 – $75,000 and get a $750 bonus (750/50000=1.50%)

Deposit and maintain $75,000 – $100,000 and get a $1,000 bonus (1000/75000=1.33%)

Deposit and maintain $100,000+ and get a $1,250 bonus (1250/100000=1.25%)

https://www.northpointe.com/promotion/Note: Promotional account pay 0.00-0.25% interest, so almost bonus only.

One can get about $625 interest in 3 months at 5.00%,

so depositing $50k to get $750 ($125 more) may NOT be worth the effort

-

Changes:

American First Credit Union MM(via SaveBetter) was 5.03% now 5.05%

Patriot Bank MM(via SaveBetter) was 5.02% now 5.05%

Capital One Bank Savings was 4.00% now 4.10%New account:

Bank5Connect Jumbo Savings(min required balance $100k) 5.10%

-

NEW: One Finance (fintech) just offered 5.00% on $5,000 minimum to $100,000 maximum when

you receive $500 a month in eligible direct deposits or have a total daily balance of $5,000 or more.

ONE is a financial technology company, not a bank.

Banking services provided by Coastal Community Bank, Member FDIC.

Approved accounts are FDIC insured up to $250,000 per depositor.

https://www.one.app/

-

Western Alliance Bank Savings(via SaveBetter) was 5.05% now 5.10%

Mission Valley Bank Savings(via SaveBetter) was 5.01% now 5.06%

CIT Bank Platinum Savings was 4.87% now 4.95%

USAlliance Financial Savings was 4.25% now 4.40%

Barclays Bank Savings was 4.00% 4.15%

SkyOne Federal Credit Union MM(via SaveBetter) was 3.75% now 5.05%

-

America First (via Raisin) was 5.05%. now 5.12%

CloudBank (via Raisin) was 5.05%. now 5.11%

Virtual Bank eMoney Market was 4.80%, now 5.00%Note: savebetter.com is now raisin.com (custodial accounts)

-

Andrews Federal Credit Union 5.75% on up to $1,000

-

@goldsheet said in Best Nationally Available High APY Liquid Accounts:

Andrews Federal Credit Union 5.75%

Special Limited-Time Only Online Savings Account

Now open to new accounts through December 31, 2023.

Compliments the base share savings account as an additional account.

Dividends are credited and compounded monthly.

If the average daily balance of the account exceeds $1,000

https://www.andrewsfcu.org/Learn/Resources/Rates/Savings-Rates$5 to open base share savings account

Easy membership via American Consumer Council (join for $8)

https://www.americanconsumercouncil.org/You did read where it says balances over $1,000 will earn 0.05%. Pretty worthless account I’d think.

Dividend Rate Tiers Dividend Rate Annual Percentage Yield (APY)

$.01 - 1,000.00 5.630% 5.75%

$1,000.01 and greater 0.050% 0.05%

-

@atikovi said in Best Nationally Available High APY Liquid Accounts:

@goldsheet said in Best Nationally Available High APY Liquid Accounts:

Andrews Federal Credit Union 5.75%

Special Limited-Time Only Online Savings Account

Now open to new accounts through December 31, 2023.

Compliments the base share savings account as an additional account.

Dividends are credited and compounded monthly.

If the average daily balance of the account exceeds $1,000

https://www.andrewsfcu.org/Learn/Resources/Rates/Savings-Rates$5 to open base share savings account

Easy membership via American Consumer Council (join for $8)

https://www.americanconsumercouncil.org/You did read where it says balances over $1,000 will earn 0.05%. Pretty worthless account I’d think.

Dividend Rate Tiers Dividend Rate Annual Percentage Yield (APY)

$.01 - 1,000.00 5.630% 5.75%

$1,000.01 and greater 0.050% 0.05%I think this is the same or very similar as the Digital Federal Credit Union account that pays 6% but just on balances up to $1,000.

-

Rising Bank Savings was 4.25% now 4.50%

Discover AAII Savings was 4.05% now 4.20%

Discover Savings was 4.00% now 4.15%

-

@jtownsucks46 Delete my post for Andrews

-

@atikovi said in Best Nationally Available High APY Liquid Accounts:

You did read where it says balances over $1,000 will earn 0.05%.

Yes, and I accidentally didn’t copy/paste the rest of the last line

"If the average daily balance of the account exceeds $1,000, the remaining

balance will be paid at the variable rate stated for the second tier."

-

Vio Cornerstone Money Market was 4.88%, now 5.02%

-

CFG was 5.12%, now 5.17%

America First CU was 5.12%, now 5.15%

Patriot Bank MM was 5.05%, now 5.15%

Ponce Bank MMDA was 5.05%, now 5.15%

Mission Valley Bank Savings was 5.06%, now 5.12%

FVC Bank MM was 5.00%, now 5.10%

Popular Direct High-Rise Savings was 5.00%, now 5.05%

http://www.rejohnsonjr.com/SAVINGS.HTM

-

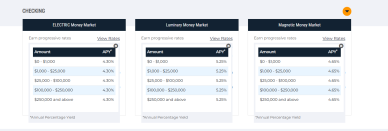

NEW: Brillant Bank Magnetic Money Market 4.65%

Appears “Brilliant Bank Luminary Money Market” is still 5.25% but no longer available.

Note: Except Arkansas, Kansas, Missouri, and Oklahoma

-

@goldsheet said in Best Nationally Available High APY Liquid Accounts:

NEW: Brillant Bank Magnetic Money Market 4.65%

Appears “Brilliant Bank Luminary Money Market” is still 5.25% but no longer available.

Note: Except Arkansas, Kansas, Missouri, and Oklahoma

When you go to open an account, there are actually 3 options that come up so hard to tell what’s really going on with Brilliant…

-

@jtownsucks46

It only shows me Electric (4.30%) and Magnetic (4.65%) = Weird ?

-

Luminary MMA no longer available for new customers. Existing customers keep the current rate at least for the time being.

-

Western State Bank MMA raised their rate to 5.15% APY.

-

Northern Bank Direct MM was 4.75% now 4.95%

-

Deleted

-

Western Alliance Bank Savings(via Raisan) was 5.10% now 5.15%

The State Exchange Bank Savings(via Raisin) was 4.85% now 5.05%

Hanover Bank MM(via Raisan) was 4.85% now 5.15%

Sallie Mae Bank MM was 4.15% now 4.25%

Sallie Mae Bank Savings was 4.05% now 4.10%

Colorado Savings Bank Savings was 4.00% now 4.25%

Smarty Pig Savings(by Sallie Mae Bank) was 3.75% now 3.85%

Emigrant Direct Savings was 3.50% now 4.00%

Self Help Credit Union MM was 2.96% now 3.05%

CommunityWide FCU Savings was 1.00% now 2.00%

-

New Raisin(SaveBetter) banks/credit unions:

Pacific Western Bank MM 5.15%

Ocean First Bank Savings 5.15%

Columbia Bank Savings 5.15%

Select Bank Savings 5.11%

Grand Bank MM 5.01%

Stage Point FCU MM 5.00%

First National Northwest Bank MM 4.85%

-

@jtownsucks46

Emigrant Direct appears to be 4.00% ?

-

@goldsheet said in Best Nationally Available High APY Liquid Accounts:

@jtownsucks46

Emigrant Direct appears to be 4.00% ?Good catch on my typo, it is 4.00% up from 3.50%. Thank you!

-

As of July 10, 2023, the annual percentage yield (APY) on your CIBC Agility™ Online Savings Account increased to 4.67% APY.