Best Nationally Available High APY Liquid Accounts

-

First Foundation was 1.00%, now 0.75%

-

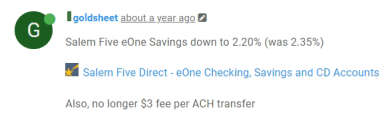

In regards to Salem 5, there is a column indicating $3 ACH fee, I called and they confirmed that there are no ACH fees, can someone else verify, and update the list?

-

@paazel No ACH fees at Salem5 for several years now.

I have done both inbound and outbound transfers, no fees.

I previously posted about no $3 fee

-

@goldsheet yes that has also been my experience, thank you for confirming!

-

Salem 5 Direct was 0.80%, now 0.61%

Vio Bank was 0.76%, now 0.66%

Synchrony Bank HYS was 0.65%, now 0.60%

-

Popular Direct continues the name change game,

Exclusive (no longer available to open) is 0.50%

Ultimate (no longer available to open) is 0.65%

NEW PRODUCT

Select is 0.70% $5,000 minimum deposit

https://www.populardirect.com/products/savings/popular-direct-select-savings/

-

Marcus is .060%, but one can get a bump up to 0.70% for AARP members

"Upon enrollment in this offer, your Marcus Online Savings Accounts will earn an Annual Percentage Yield (APY) that is .10% higher (the “APY Bonus”)

than the stated APY available at www.marcus.com for a period of 24 months, beginning on the date of enrollment "

More information and enrollment link here:

https://www.marcus.com/us/en/disclosure/savings-rate-bonus-offer-details

-

We’re writing to let you know the Annual Percentage Yield (APY) on your HSBC

Direct Savings account is changing from 0.50% to 0.30% starting November 03, 2020.

-

Alliant Credit Union was 0.65%, now 0.55%

https://www.alliantcreditunion.org/bank/high-yield-savings

CIBC was 0.70%, now 0.62%

https://us.cibc.com/en/agility/agility-savings.html

-

Discover Savings was 0.60%, now 0.55%

-

Merchants Bank of Indiana Money Market Savings

1.00% APY

Minimum balance to open account is $50

No minimum balance to earn APY

https://www.merchantsbankofindiana.com/personal-banking/#money-market

-

Popular Direct

Exclusive (no longer available) is 0.50%, unchanged.

Ultimate (no longer available) was 0.65%, now 0.60%

Select was 0.70%, now 0.65%

-

ConnectOneBank Online Savings is 0.80%, showing on their websites.

https://www.connectonebank.com/Personal/Accounts/One-Connection-Savings

-

CFG Bank Online High Yield Money Market is not 0.80% any more. It is showing 0.76% on the website.

-

Marcus: 0.50%

-

We’re writing to let you know the Annual Percentage Yield (APY) on your HSBC Direct Savings account is changing from 0.30% to 0.15%1 starting November 24, 2020.

-

@goldsheet said in Best Nationally Available High APY Liquid Accounts:

We’re writing to let you know the Annual Percentage Yield (APY) on your HSBC Direct Savings account is changing from 0.30% to 0.15%1 starting November 24, 2020.

Even with today’s crappy rates, I doubt anyone here would have something paying only 0.30%.

-

@atikovi HSBC used to be reasonably competitive but has dropped faster than most, down to only 0.15%

-

An email was received from Live Oak Bank saying their savings rate will be 0.60% (from 0.70%).

-

CIT money Market was 0.55% , now 0.50%

CIT Savings Builder was 0.50% , now 0.45%

-

Capital One 360 Performance Savings is 0.40% now.

-

Ally bank:

we’re writing to let you know that the Annual Percentage Yield (APY) for your Online Savings Account is changing from 0.60% APY to 0.50% APY on all balance tiers. Your new APY is effective 12/11/2020 and will show online in your account details on 12/12/2020.

-

CIBC was 0.62%, now 0.52%

Simple Savings was 0.60%, now 0.50%

-

All Top Three Rates Have Dropped

Merchant’s Bank Money Market Savings was 1.00%, now 0.75%

National Cooperative Bank Impact Money Market was 0.91%, now 0.60%

Community Wide Federal Credit Union High Rate Quarterly was 0.90%, now 0.70%ConnectOneBank Online Savings was 0.70%, now 0.65%

Northern Bank Direct was 0.60%, now 0.50%

Simple Savings was 0.60%, now 0.50%

PenFed Premium Online Savings was 0.60%, now 0.55%

Community Wide Federal Credit Union High Rate Monthly was 0.60%, now 0.40%

Rising Bank High Yield Savings Account was 0.60%, now 0.50%

Ally Bank Online Savings was 0.60%, now 0.50%

American Express HYS was 0.60%, now 0.50%

Able Banking MMA was 0.60%, now 0.50%

-

Looks like Merchant’s Bank IN rate on Money Market Savings is now .75%, down from 1.0%

-

@platypus got it in my list above

-

@goldsheet Sorry, missed it. I’ll delete my post if I can. Rate drops are painful…

-

@platypus It’s OK.

I started at the top and just kept going down until I got bored, pained, and depressed.

-

ConnectOne Bank Online Savings was 0.70%, now 0.65%

PenFed Premium Online Savings was 0.60%, now 0.55%

Rising Bank High Yield Savings Account was 0.60%, now 0.50%

Salem Five eOne Savings was 0.61%, now 0.50%

-

First Foundation savings account was 0.75% now 0.60%

-

@atikovi just read the dreaded email

"We’re writing to let you know the interest rate on our Online

Savings account is changing. Starting January 8, our Online

Savings account will earn 0.60% Annual Percentage Yield (APY). "

-

Just waiting for the ball to drop on my Customers Bank 1% business checking account.

-

Vio High Yield Online Savings Account was 0.66%, now 0.57%

Varo Savings was 0.81%, now 0.40%

CFG Bank Online High Yield Money Market was 0.72%, now 0.68%

-

Customers Bank Ascent MMA .80 % to .75%

-

MARCUS BONUS

Boost your savings with a $100 Bonus

Get $100 when you deposit $10,000 or more in new funds into a new or

existing Online Savings Account within 10 days of enrollment, and maintain

those funds plus your current balance for 90 days. Must enroll by 2/12/2021.

-

Deposit at least $100 a month—for 12 consecutive months—into

The Ultimate Opportunity Savings Account.

Not only will you earn the current interest rate of 0.55% APY,

but after those 12 consecutive months, you’ll also get a $100 bonus!

https://ww2.alliantcreditunion.org/ultimate-opportunity-savings

-

Popular Direct Select Savings 0.55%

Exclusive (no longer offered) 0.50%

Ultimate (no longer offered) 0.50%

-

deleted

-

@goldsheet Last three times this was posted said you had to be a T-Mobile customer. Is it true a Non-t-Mobile customer can get (only the 1.00 %), not the bonus rate ? Anyone not a T-mobile customer confirm ?

-

@goldsheet said in Best Nationally Available High APY Liquid Accounts:

To sign up via the web app, visit https://join.t-mobilemoney.com and follow the instructions to open an account.

T-Mobile MONEY accounts are held at BankMobile, a division of Customers Bank. Member FDIC.

- That sends you to a application form. Where are the details and terms of the account posted?

- If you already have a Customers Bank account, would you have to figure those deposits into this account to stay under the $250K FDIC insurance limit?

-

deleted

-

deleted

-

@goldsheet said in Best Nationally Available High APY Liquid Accounts:

@atikovi

since T-Mobile deposits are held at Customers Bank,

I would think $250,000 is the maximum combined insurance level.Unfortunately that’s what I thought.

-

Comments about T-Mobile Money:

https://www.depositaccounts.com/banks/tmobile-money.html

https://www.doctorofcredit.com/t-mobile-money-review-earn-4-apy-on-balances-up-to-3000/

-

Deleted my T-Mobile MONEY posts

-

SFGI: 0.56%

Discover: 0.45%

Barclays: 0.40%

-

@booksleuth said in Best Nationally Available High APY Liquid Accounts:

@goldsheet Last three times this was posted said you had to be a T-Mobile customer. Is it true a Non-t-Mobile customer can get (only the 1.00 %), not the bonus rate ? Anyone not a T-mobile customer confirm ?

I am not a T-mobile customer and my T-mobile Money account is getting the 1%.

-

MySavingsDirect down to .30%.

DollarSavingsDirect down to .40%.

-

MySavingsDirect down to .25%.

DollarSavingsDirect down to .35%.

-

Customers Bank Ascent MM interest down to 0.60% per email received 3/9/21