Best Nationally Available High APY Liquid Accounts

-

Merchants Bank will no longer originate external transfers from other banks. They told me I would have to originate it at the sending bank. That doesn’t work for me, as my bank charges a fee for ACH transfers. So while they’re still paying 0.75%, I’m going to look elsewhere to avoid the fees.

-

@platypus said in Best Nationally Available High APY Liquid Accounts:

Customers Bank Ascent MM interest down to 0.60% per email received 3/9/21

Did the email say when it was dropping? Website still shows 0.75%

-

American Express Savings dropped to 0.50% to 0.40% today.

-

@jtownsucks46 Yes, here’s the email:

We hope that you and those for whom you care are safe and well.

Snow that covered much of the country is melting! Spring is coming! Vaccines are available!

Okay, that’s the good news. Unfortunately, your Ascent Money Market Savings Account rate is going down.

But just a little.

So, we are writing to tell you that effective March 16, 2021, we will be reducing the Ascent Money Market Savings rate from 0.75% to 0.60% APY*.

-

New fintech: ZYNLO Bank (FDIC/DIF Insured)

Services provided by PeoplesBank, Holyoke, MA.

Open your More Money Market Account today

Use the promo code “BANK” to qualify for a special rate of 1.25%

UPDATE: Just tried to open an account and it is not available in 4 states:

California, Connecticut, Massachusetts, and New York. (good in 46 others)

(post subject to moderator deletion since not “Nationally Available” )

https://zynlobank.com/bank/

-

"Who is ZYNLO?

We’re an online bank created to provide people with flexibility in their banking. Funds are held by our parent company, PeoplesBank. Unlike many other online institutions, deposits with us are 100% insured – in other words there is no maximum amount of coverage."So are they FDIC insured, and if so, how are deposits over $250,000 fully insured?

-

@atikovi Thanks for the headsup on ZYNLO. Their round-up + match feature is v. interesting.

-

@atikovi

I called them and was informed that the promo rate is for their MM account and the 1.25% rate is for up to $250K. Over that, the rate is 0.1%. The regular savings rate is 0.4%. And the CS doesn’t know how long the 1.25% will last – that is for people who get in on the promo rate.It is interesting that I can’t find any of their interest rates on their web site.

Also, their electronic transfer out of the account is limited to $50K/month and can be approved on a case by case basis for an add’l $50K for a total of $100K/mo.

-

I went and signed up yesterday. Already have external accounts set up today, so they are fast. Will see how long that rate lasts.

-

@atikovi Deposits over $250k are privately insured by Depositors Insurance Fund (DIF).

https://www.difxs.com/DIF/Home.aspx

Massachusetts-based member banks only.

https://www.difxs.com/DIF/DIFMemberBanks.aspx

-

@goldsheet Yes I saw that but pretty moot if the rate goes to 0.10%. I assume only one account per person.

-

I could not find where to put in the promo code “BANK”, is that necessary?

-

Could you not pull out any amount over the limit from an external account via an ACH?

-

@alanmax

Nevermind.

-

From Deposit Accounts

"Another rate cut that wasn’t straightforward was at Paramount Bank. The Bank added a balance cap to its High-Interest Checking Account. Before this change, the interest rate was 0.85% on all balances. Now the 0.85% applies only to balances under $100k. According to the small print, “0.10% for accounts with balances over $100,000.00.” This sounds like the entire $100k+ balance will earn only 0.10% rather than only the portion of the balance over $100k. In either case, customers should no longer maintain balances above $100k in this account."UPDATE (04/09/2021): I spoke to them on the phone today and was told accounts opened prior to March 24 are grandfathered and will earn 0.85% on the ENTIRE balance.

-

Brio Direct now offers a “High-Yield Money Market” at 0.60%

https://www.briodirectbanking.com/high-yield-money-market/If you currently have the Brio Direct “High Yield Savings” at only 0.40% it should be easy to move to new higher rate account.

-

Customers Bank business interest checking drops from 1.00% to 0.50% on April 20th.

-

Paramount checking is now .75%. One thing I’ve encountered with them is that incoming external transfers are limited to $5K per day. I can’t deal with such low limits. I’ll be looking for alternatives. Will Zynlo allow multiple accounts?

-

They denied my online application saying I applied for TWO accounts, which I didn’t. Wouldn’t their online application form prevent you from opening more than one account anyway?

-

Vio Bank now has a “Cornerstone Money Market Account” paying 0.61%

a little better than their 0.57% “High Yield Online Savings Account”

(very easy to open and fund new account if you already have savings account)

https://www.viobank.com/cornerstone-money-market

-

First Foundation was 0.60%, now 0.50%

-

Minor changes

CFG Bank Online High Yield Money Market was 0.62%, now 0.59%

Brio High-Yield Money Market was 0.60%, now 0.55%

Prime Alliance Personal Savings was 0.60%, now 0.50%

All America Bank Mega MM was 0.50%, now 0.40%

Redneck Mega MM was 0.50%, now 0.40%

Popular Direct Select Savings 0.45%

(Popular Direct Ultimate and Exclusive no longer offered)

Salem Five eOne Savings was 0.45%, now 0.40%

Synchrony Bank HYS was 0.40%, now UP to 0.50%

Envision Bank Savvy Savings was 0.30%, now 0.25%Note: went through entire list down to Envision Bank Savvy Savings

Figured 0.25% and less wasn’t worth the effort

-

Top one on list dropped

Paramount High Interest Checking was 0.75%, now 0.65%

-

Zynlo MMA drops from 1.25% to 0.80% effective 8/2. It was good while it lasted.

-

Paramount “High Interest Checking” is no longer available.

They now have an “Interest Checking” with a low rate.

“The Annual Percentage Yield (APY) and the Rate of the Interest Checking Account is 0.30% as of July 10, 2021 for accounts with balances up to $99,999.99”

-

Need to make a clarification / correction.

Paramount got confusing with their account names

"High Interest Checking" (no longer available) has a rate of 0.55% on entire balance.

New offering is “Interest Checking” at 0.30% up to $99.999.99. 0.10% above $100,000.00

-

VIO BANK

Cornerstone Money Market Account was 0.61%, now 0.56%

High Yield Online Savings Account was 0.56%, now 0.51%

-

Kabbage checking paying 1.1% on balances up to $100K. Wonder how long that rate will last?

https://www.kabbage.com/checking/

-

@platypus Should have noted “business” checking

-

Application submitted. They ask for a pdf of your latest business bank statement and some legal business document. Otherwise pretty simple.

-

@atikovi I didn’t have to do that. I applied as a sole proprietor under my name & SSN. Nothing further needed. My opening deposit is still pending, so I can’t see if I’ll be able to do ACH transfers out or if I’ll have to write a check. I just hope they don’t drop the interest rate right away.

-

Same here. Still asked for those docs.

-

@atikovi Interesting. I must have been lucky. Opening deposit has cleared. ACH transfers in & out allowed. No fees. I’m happy. Only hitch is $6,000 per day max & you can’t schedule future transfers. So that’s kind of a pain if you want to transfer in a larger amount. Guess you could write a check & do a mobile deposit. I haven’t tried it yet, though.

-

@platypus said in Best Nationally Available High APY Liquid Accounts:

Only hitch is $6,000 per day max & you can’t schedule future transfers.

No message of account being open since applying so I checked online and see I do have have an account and routing number. Initiated a $50K transfer from an external 0.50% interest account. Hope their 1.10% lasts.

-

@atikovi So maybe opening deposit isn’t limited? LMK if you do another transfer & if it’s limited to $6K. I sent them an email to see if they’d raise it.

-

Initiated a $50K transfer from my Customers Bank account to Kabbage on Wednesday. It was in Kabbage on Thursday. Did another transfer for $49.5K yesterday. I see it in my account this morning.

-

@atikovi I need to move some money & do that. I was trying to transfer from my regular checking & they charge a fee for ACH transfers to outside banks. It’s doable, but it will take a little work. Just wish Kabbage would raise the $6K transfer limit. I hate having to jump through hoops.

-

Table updated with recent rate changes for all accounts.

-

@jtownsucks46 said in Best Nationally Available High APY Liquid Accounts:

Table updated with recent rate changes for all accounts.

Thanks. I didn’t realize that PenFed actually went UP, from 0.45% to 0.50%.

-

New nationally available account added:

Bank Onward 0.65%

https://www.bankwithbo.com/products

-

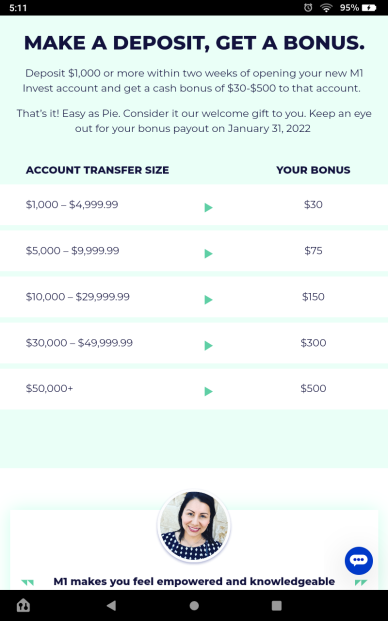

M1 Finance is a fintech providing INVEST (SIPC brokerage) and SPEND (FDIC bank)

Current promotion: Get up to $500 opening and funding in first 14 days.

Bonus payout will be on January 31, 2022

M1 Plus (normally $125/yr) is free for the first year and bumps SPEND to 1.00%APY

(M1 Spend checking accounts furnished by Lincoln Savings Bank, Member FDIWARNING - Here’s the catch

"Reallocation of any funds transferred externally, or internally to any other M1 services (e.g., M1 Spend), prior to the Pay-out Date will disqualify you from this Promotion."

STRATEGY:

Open INVEST (brokerage)

Leave money there until you get bonus on 1/31/22

Then you can move it over to SPEND (bank) to get 1% APY

https://www.m1finance.com/fund-500-bonus/

-

@goldsheet Thanks.

-

@my4mainecoons

I did the full $50K figuring I would lose 3 months of interest (50K*1%/4=$125) but get $500, so net $375 aheadThis is bank thread, but bonus from Tastyworks brokerage was crazy.

Deposit $10K on 11/1, paid bonus of $500 (5%) on 11/2

"Funds must remain in the account (minus any trading losses) for a minimum of three (3) months or the cash credit(s) may be surrendered."

https://info.tastyworks.com/opennow

-

IDK if this is the right place to post this but if you’re going to transfer $50K to Capital One for the $450 bonus the deadline is Dec. 17. I was thinking that it was Dec. 31st but I was wrong.

This is for existing Capital One 360 Money Market acct holders. The last time they offered this I set up an automatic withdrawl for 2 days after the end date. Received the bonus and the $50K moved to another bank. Now its available to move back to Capital One.Earn a $450 bonus when you deposit $50,000 or more, or earn $150 when you deposit $20,000-$49,999.99, of new money from an external account into your 360 Money Market account ending in 0000 by December 17, 2021.

Keep your deposit in your account until at least March 17, 2022.

-

So what’s the effective interest rate of $450 interest for 3 months on $50K considering you would take it from another account earning say 0.80 % into this one only earning 0.30%?

-

@atikovi well mine is going from an account where its earning 0%

-

PenFed to 0.55% from 0.50%.

-

deleted

-

Why would you use My Marcus when T-Mobile money is still 1.00% ? I’m all in favor of referrals, but come on !

-

The one problem with T-Mobile Money is that you can’t add beneficiaries…

You can with Marcus…