@booksleuth said in Best Nationally Available High APY Liquid Accounts:

@goldsheet I am grateful to all advice from this board.

You’re welcome

@booksleuth said in Best Nationally Available High APY Liquid Accounts:

@goldsheet I am grateful to all advice from this board.

You’re welcome

@dionaea Like your real estate tax method,

Instead of making 2 payments per year, I let one slide into next year.

As a result, every other year I have only 1 tax payment, so take standard deduction.

Then following year have 3 tax payments, so itemize.

Also, I make little charitable contributions in the standard deduction year, then double the amount in the itemize year.

Everything, except fried onions, in one store, but two trips required.

@my4mainecoons

I did the full $50K figuring I would lose 3 months of interest (50K*1%/4=$125) but get $500, so net $375 ahead

This is bank thread, but bonus from Tastyworks brokerage was crazy.

Deposit $10K on 11/1, paid bonus of $500 (5%) on 11/2

"Funds must remain in the account (minus any trading losses) for a minimum of three (3) months or the cash credit(s) may be surrendered."

https://info.tastyworks.com/opennow

M1 Finance is a fintech providing INVEST (SIPC brokerage) and SPEND (FDIC bank)

Current promotion: Get up to $500 opening and funding in first 14 days.

Bonus payout will be on January 31, 2022

M1 Plus (normally $125/yr) is free for the first year and bumps SPEND to 1.00%APY

(M1 Spend checking accounts furnished by Lincoln Savings Bank, Member FDI

WARNING - Here’s the catch

"Reallocation of any funds transferred externally, or internally to any other M1 services (e.g., M1 Spend), prior to the Pay-out Date will disqualify you from this Promotion."

STRATEGY:

Open INVEST (brokerage)

Leave money there until you get bonus on 1/31/22

Then you can move it over to SPEND (bank) to get 1% APY

https://www.m1finance.com/fund-500-bonus/

VIO BANK

Cornerstone Money Market Account was 0.61%, now 0.56%

High Yield Online Savings Account was 0.56%, now 0.51%

Need to make a clarification / correction.

Paramount got confusing with their account names

"High Interest Checking" (no longer available) has a rate of 0.55% on entire balance.

New offering is “Interest Checking” at 0.30% up to $99.999.99. 0.10% above $100,000.00

Paramount “High Interest Checking” is no longer available.

They now have an “Interest Checking” with a low rate.

“The Annual Percentage Yield (APY) and the Rate of the Interest Checking Account is 0.30% as of July 10, 2021 for accounts with balances up to $99,999.99”

Top one on list dropped

Paramount High Interest Checking was 0.75%, now 0.65%

Minor changes

CFG Bank Online High Yield Money Market was 0.62%, now 0.59%

Brio High-Yield Money Market was 0.60%, now 0.55%

Prime Alliance Personal Savings was 0.60%, now 0.50%

All America Bank Mega MM was 0.50%, now 0.40%

Redneck Mega MM was 0.50%, now 0.40%

Popular Direct Select Savings 0.45%

(Popular Direct Ultimate and Exclusive no longer offered)

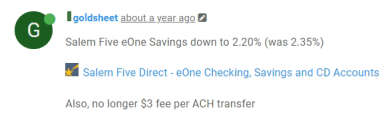

Salem Five eOne Savings was 0.45%, now 0.40%

Synchrony Bank HYS was 0.40%, now UP to 0.50%

Envision Bank Savvy Savings was 0.30%, now 0.25%

Note: went through entire list down to Envision Bank Savvy Savings

Figured 0.25% and less wasn’t worth the effort

First Foundation was 0.60%, now 0.50%

Vio Bank now has a “Cornerstone Money Market Account” paying 0.61%

a little better than their 0.57% “High Yield Online Savings Account”

(very easy to open and fund new account if you already have savings account)

https://www.viobank.com/cornerstone-money-market

Brio Direct now offers a “High-Yield Money Market” at 0.60%

https://www.briodirectbanking.com/high-yield-money-market/

If you currently have the Brio Direct “High Yield Savings” at only 0.40% it should be easy to move to new higher rate account.

From Deposit Accounts

"Another rate cut that wasn’t straightforward was at Paramount Bank. The Bank added a balance cap to its High-Interest Checking Account. Before this change, the interest rate was 0.85% on all balances. Now the 0.85% applies only to balances under $100k. According to the small print, “0.10% for accounts with balances over $100,000.00.” This sounds like the entire $100k+ balance will earn only 0.10% rather than only the portion of the balance over $100k. In either case, customers should no longer maintain balances above $100k in this account."

UPDATE (04/09/2021): I spoke to them on the phone today and was told accounts opened prior to March 24 are grandfathered and will earn 0.85% on the ENTIRE balance.

@atikovi Deposits over $250k are privately insured by Depositors Insurance Fund (DIF).

https://www.difxs.com/DIF/Home.aspx

Massachusetts-based member banks only.

https://www.difxs.com/DIF/DIFMemberBanks.aspx

New fintech: ZYNLO Bank (FDIC/DIF Insured)

Services provided by PeoplesBank, Holyoke, MA.

Open your More Money Market Account today

Use the promo code “BANK” to qualify for a special rate of 1.25%

UPDATE: Just tried to open an account and it is not available in 4 states:

California, Connecticut, Massachusetts, and New York. (good in 46 others)

(post subject to moderator deletion since not “Nationally Available” )

https://zynlobank.com/bank/

Deleted my T-Mobile MONEY posts

Popular Direct Select Savings 0.55%

Exclusive (no longer offered) 0.50%

Ultimate (no longer offered) 0.50%

Deposit at least $100 a month—for 12 consecutive months—into

The Ultimate Opportunity Savings Account.

Not only will you earn the current interest rate of 0.55% APY,

but after those 12 consecutive months, you’ll also get a $100 bonus!

https://ww2.alliantcreditunion.org/ultimate-opportunity-savings

MARCUS BONUS

Boost your savings with a $100 Bonus

Get $100 when you deposit $10,000 or more in new funds into a new or

existing Online Savings Account within 10 days of enrollment, and maintain

those funds plus your current balance for 90 days. Must enroll by 2/12/2021.

Vio High Yield Online Savings Account was 0.66%, now 0.57%

Varo Savings was 0.81%, now 0.40%

CFG Bank Online High Yield Money Market was 0.72%, now 0.68%

@atikovi just read the dreaded email

"We’re writing to let you know the interest rate on our Online

Savings account is changing. Starting January 8, our Online

Savings account will earn 0.60% Annual Percentage Yield (APY). "

ConnectOne Bank Online Savings was 0.70%, now 0.65%

PenFed Premium Online Savings was 0.60%, now 0.55%

Rising Bank High Yield Savings Account was 0.60%, now 0.50%

Salem Five eOne Savings was 0.61%, now 0.50%

@platypus It’s OK.

I started at the top and just kept going down until I got bored, pained, and depressed.

@platypus got it in my list above

All Top Three Rates Have Dropped

Merchant’s Bank Money Market Savings was 1.00%, now 0.75%

National Cooperative Bank Impact Money Market was 0.91%, now 0.60%

Community Wide Federal Credit Union High Rate Quarterly was 0.90%, now 0.70%

ConnectOneBank Online Savings was 0.70%, now 0.65%

Northern Bank Direct was 0.60%, now 0.50%

Simple Savings was 0.60%, now 0.50%

PenFed Premium Online Savings was 0.60%, now 0.55%

Community Wide Federal Credit Union High Rate Monthly was 0.60%, now 0.40%

Rising Bank High Yield Savings Account was 0.60%, now 0.50%

Ally Bank Online Savings was 0.60%, now 0.50%

American Express HYS was 0.60%, now 0.50%

Able Banking MMA was 0.60%, now 0.50%

CIBC was 0.62%, now 0.52%

Simple Savings was 0.60%, now 0.50%

CIT money Market was 0.55% , now 0.50%

CIT Savings Builder was 0.50% , now 0.45%

@atikovi HSBC used to be reasonably competitive but has dropped faster than most, down to only 0.15%

We’re writing to let you know the Annual Percentage Yield (APY) on your HSBC Direct Savings account is changing from 0.30% to 0.15%1 starting November 24, 2020.

Popular Direct

Exclusive (no longer available) is 0.50%, unchanged.

Ultimate (no longer available) was 0.65%, now 0.60%

Select was 0.70%, now 0.65%

Merchants Bank of Indiana Money Market Savings

1.00% APY

Minimum balance to open account is $50

No minimum balance to earn APY

https://www.merchantsbankofindiana.com/personal-banking/#money-market

Discover Savings was 0.60%, now 0.55%

Alliant Credit Union was 0.65%, now 0.55%

https://www.alliantcreditunion.org/bank/high-yield-savings

CIBC was 0.70%, now 0.62%

https://us.cibc.com/en/agility/agility-savings.html

We’re writing to let you know the Annual Percentage Yield (APY) on your HSBC

Direct Savings account is changing from 0.50% to 0.30% starting November 03, 2020.

Marcus is .060%, but one can get a bump up to 0.70% for AARP members

"Upon enrollment in this offer, your Marcus Online Savings Accounts will earn an Annual Percentage Yield (APY) that is .10% higher (the “APY Bonus”)

than the stated APY available at www.marcus.com for a period of 24 months, beginning on the date of enrollment "

More information and enrollment link here:

https://www.marcus.com/us/en/disclosure/savings-rate-bonus-offer-details

Popular Direct continues the name change game,

Exclusive (no longer available to open) is 0.50%

Ultimate (no longer available to open) is 0.65%

NEW PRODUCT

Select is 0.70% $5,000 minimum deposit

https://www.populardirect.com/products/savings/popular-direct-select-savings/

Salem 5 Direct was 0.80%, now 0.61%

Vio Bank was 0.76%, now 0.66%

Synchrony Bank HYS was 0.65%, now 0.60%

@paazel No ACH fees at Salem5 for several years now.

I have done both inbound and outbound transfers, no fees.

I previously posted about no $3 fee

First Foundation was 1.00%, now 0.75%

Gold Coast Bank Money Market Account

https://www.goldcoastbank.net/money-market-account/

0.00 to 4,999.99 0.25% APY

5,000.00 to 9,999.99 0.38% APY

10,000.00 to 19,999.99 0.50% APY

20,000.00 to 29,999.99 0.63% APY

30,000.00 to 39,999.99 0.75% APY

40,000.00 to 49,999.99 0.88% APY

50,000+ 1.01% APY

Northern Bank Direct was 0.75%, now 0.60%

I was not aware this had happened:

This came from my bank, Nationwide Banking by Axos, other banks may have their own limits and fees.

Withdrawal Limits Have Been Removed for Nationwide Banking by Axos

You may have heard that the Federal Reserve System’s Board of Governors announced amendments to Regulation D earlier this year.

Here’s what this means for you:

Moving forward, the six-transfer limit on withdrawals from savings deposit accounts has been removed.

This means that, depending on your available balance, you may initiate an unlimited amount of external transfers and withdrawals from savings and money market accounts without penalty.

Customers Bank Ascent Money Market Savings was 1.10%, now 0.80%

Community Wide Federal Credit Union High Rate Quarterly was 1.00%, now 0.90%

CIBC was 0.80%, now 0.70%

Synchrony was 0.75%, now 0.65%

TIAA was 0.75%, now 0.65%

IGO Banking, rate still 0.75% URL moved to

https://www.igobanking.com/our-products/money-market/

BankPurely still 0.75%, URL moved to:

https://www.bankpurely.com/purely-money-market/

Discover AAII was 0.75%. now 0.65%

Discover OSA was 0.70%. now 0.60%