Best Nationally Available High APY Liquid Accounts

-

Savings, Checking, and Money Market Accounts - Nationally Available Liquid Accounts

WSJ Prime Rate : 7.50% - Difference from best liquid account: 2.75%

Fed Funds Target Rate : 4.25%-4.50%

Next FOMC meetingAPY Eff Bank/CU/Other Min Max Hard Inq Checks Debit Card ACH Orig/Des PWF Notes 5.00% 2/21/25 ROGER Savings $1 No Max N N N Y/Y - A ROGER checking account is required to open a ROGER savings account. Balances over $250k do not earn interest. 5.00% 2/21/25 Evergreen Wealth Savings $25k No Max N N N Y/Y - A deposit of $25,000 is required to open your high-yield bank accounts. This deposit opens your High Yield Checking and Savings accounts. 4.75% 11/15/24 Modern Bank High Yield Money Market $100k ? ? N N Y/Y - 100k min balance to open and receive interest ongoing. 4.65% 2/6/25 State Bank of Texas Money Market $1 ? ? ? N Y/Y - $100,000 minimum deposit required to earn rate 4.60% 3/14/25 Neighbor’s Bank Savings $1 $250k N N N Y/Y - 4.60% 2/6/25 Pibank Savings $1 ? ? ? N Y/Y - 4.56% 3/19/25 Patriot Bank Money Market $1 No Max N N N Y/Y - $100 minimum opening deposit required but no ongoing minimum 4.56% 2/21/25 OMB Bank High Interest Savings $1 ? ? ? N Y/Y - 5k minimum to open the account; no ongoing minimum. Interest is both compounded and credited quarterly. During any calendar month, you may not make more than eight (8) withdrawals or transfers. A transaction fee of $3.00 will be charged for each debit transaction in excess of twenty-four (24) per quarter. 4.55% 1/16/25 Timbr Savings $1000 ? N N N Y/Y - Timbr is a division of Bridgewater Bank. $1,000 minimum to open. 4.54% 3/7/25 Peak Bank Envision Savings $1 ? ? ? N Y/Y - $100 to open; no ongoing minimum. 4.50% 3/14/25 Brio Direct High Yield Savings $25 ? ? N N Y/Y - $5k minimum opening deposit; ongoing minimum balance to earn APY is $25 4.50% 2/21/25 Brilliant Bank Surge Money Market $1 No Max ? ? ? Y/Y - Nationally available except AR, KS, MO, and OK. Minimum $2,000 balance to avoid $10 monthly service charge. There is a $2.55 charge for external transfers initiated at Brilliant Bank and 5k daily/monthly limit on transfers initiated at Brilliant Bank. 4.50% 1/10/25 Lending Club High Yield Savings $100 ? ? N Y Y/Y - Requires $250 monthly deposit. Without $250 monthly deposit, account pays 4.30%. 4.50% 1/7/25 Poppy Bank Premier Online Savings $1000 ? ? N N Y/Y - A minimum balance of $1,000 must be maintained to obtain the advertised Annual Percentage Yield. Electronic statements must be activated, and enrollment maintained, to avoid a monthly $5.00 paper statement fee. 4.50% 12/19/24 First Foundation Online Money Market $1 ? ? N N ? - The minimum balance to open the Online Money Market Account is $1,000; new money only. The minimum balance to earn the APY is $0.01. External transfer limits are $100,000 per day/settlement period, and up to $250,000 per rolling 30-day period. 4.50% 12/19/24 First Foundation Online Savings $1 ? ? N N ? - External transfer limits are $100,000 per day/settlement period, and up to $250,000 per rolling 30-day period. 4.47% 3/14/25 Total Direct Bank Money Market $2500 $1M ? ? ? Y/Y - Nationally available except FL and US territories. Minimum opening balance is $25,000. Minimum ongoing balance to earn advertised interest rate is $2,500. Balances below $2,500 do not earn interest. Limited to 6 withdraws/transfer each month with $10 fee charged for any additional. 4.46% 1/14/25 Vio Cornerstone Money Market $1 ? ? N Y Y/Y - $100 minimum to open. A $10 fee will be charged for each withdrawal in excess of 6 per monthly statement cycle. $5 fee to receive paper statements. 4.45% 2/20/25 Newtek Bank Personal High Yield Savings $1 No Max ? N N Y/Y - No minimum balance to open, but customers must have a balance of $0.01 to earn interest. You may make up to 6 withdrawals from your Newtek Bank, N.A. Savings account per statement cycle, including preauthorized, automatic and telephone transfers. 4.42% 12/19/24 First Internet Bank Savings $1M No Max ? ? ? ? - 1M minimum balance required. Balances below 1M earn 3.77%. Must maintain $4,000 average daily balance to waive $5 monthly fee. 4.40% 3/7/25 MyBankingDirect Savings $1 ? Y - - - $500 to open; no ongoing minimum 4.40% 3/7/25 Open Bank High Yield Savings $1 No Max N N N Y/Y - Nationally available except for Connecticut, Delaware, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, and Rhode Island. Minimum opening deposit of $500 required. 4.40% 1/17/25 Bread Financial High Yield Savings(formerly Comenity Direct Bank) $100 ? ? N N Y/Y - Maximum deposit limit of $1 million per account and $10 million limit per customer 4.40% 1/10/25 Rising Bank High Yield Savings Account $1,000 500k ? ? ? Y/Y - 4.40% 1/8/25 Zynlo Bank Money Market $1 No Max N N N Y/Y - 4.40% 9/27/24 All America Bank Mega Money Market $1 $100k N N Y Y/Y - $100k max 4.40% 9/27/24 Redneck Mega Money Market $1 $100k N N Y Y/Y - $100k max 4.39% 2/6/25 Raisin Platform Highest Rate $1 ? ? N N Y/Y - 4.35% 2/6/25 Bask Bank Savings $1 ? ? N N Y/Y - 4.35% 1/14/25 Zynlo Bank Tomorrow Savings $1 No Max N N N Y/Y - 4.35% 1/10/25 Primus Bank Savings $1 ? ? N N Y/Y New customer sign-ups currently on hold. Free incoming wires. 4.35% 3/29/23 b1BANK High Yield Savings $1 ? ? ? ? ?/? - This account can only be opened with funds not currently on deposit with b1BANK. $0 quarterly service charge if account receives eStatements. ($5.00 paper statement fee.) 4.32% 2/20/25 CFG Bank Online High Yield Money Market $1000 No Max ? N Y Y/Y - Minimum balance of $1,000 must be maintained to earn advertised interest rate 4.30% 2/6/25 CIT Bank Platinum Savings $1 No Max ? N N Y/Y - $100 to open; no ongoing minimum. Balances $5k+ earn 4.85%. Balances less than 5k earn 0.25%. 4.30% 1/24/25 Western Alliance Bank Savings Premier $1 ? ? ? N Y/Y - $500 minimum deposit to open; no ongoing minimum 4.30% 1/17/25 EverBank Performance Savings $1 ? ? Y Y Y/Y - Previously was TIAA Bank. 4.28% 2/6/25 CIBC Agility Online Savings $1k $1,000,000 ? N N ? - Initial deposit limited to no more than $250k 4.26% 1/10/25 Tab Bank High Yield Savings $1 No Max ? N N Y/Y - $2,500 to open and $1 minimum ongoing to earn advertised interest rate. E-statements are free; paper statements $5 a month. 4.26% 7/21/23 SFGI Direct Savings $500 ? N N N Y/Y - $500 min to open. Only 1 external account 4.25% 3/7/25 Republic Bank of Chicago Digital Money Market $2,500 ? ? ? ? ? - Nationally available except IL, IN, MI, and WI. $2,500 minimum balance required to avoid $25 monthly fee and earn interest. External Transfers using Republic Bank’s transfer service: The monthly maximum is 10 total external transfers, not to exceed the aggregate monthly total of $10,000.00. The individual transfer limit is $2,500.00 per transaction. 4.25% 3/7/25 Quontic Money Market $1 No Max ? N Y Y/Y - Minimum opening balance of $100 required. If the account is closed before interest and/or bonus is credited, accrued interest and/or bonus may be forfeited for that statement cycle. 4.25% 12/19/24 Evergreen Bank Group High Yield Online Savings $1 ? ? N N Y/Y - $100 min required to open; no ongoing min; capped at 1M 4.25% 12/18/24 Merchant’s Bank Money Market Savings $1 $1M ? N N Y/Y - $50 to open but no ongoing minimum balance 4.25% 12/18/24 Virtual Bank Money Market $1 ? ? ? ? ? - 4.25% 12/18/24 Ivy Bank High Yield Savings $2,500 1M ? ? ? Y/Y - Nationally available except CA. Balances below $2,500 do not earn interest. 4.20% 3/14/25 Jenius Bank Savings $1 ? ? ? N Y/Y - Not available to residents of Hawaii or New Mexico. 4.20% 3/7/25 Popular Direct Select Savings $1 ? ? N N Y/Y - $100 to open; no ongoing minimum 4.20% 2/13/25 Colorado Federal Savings Bank High Yield Savings $1 No Max ? N N Y/Y - Only allows transfers to & from original linked account. New customers who deposit a minimum of 50k may choose to open a Premier Savings account which pays 4.25% 4.20% 1/10/25 Primus Bank Premium Checking $1 ? ? N N Y/Y New customer sign ups currently on hold. Foreign ATM fees reimbursed. First check order is free. Free incoming wires. 4.20% 12/9/24 Live Oak Bank Savings $1 ? N N Y Y/Y - 4.15% 12/27/24 Prime Alliance Personal Savings $1 ? ? ? ? Y/Y - 4.15% 2/20/25 Bank5 Connect Jumbo Savings $25k No Max ? N N Y/Y - 25k minimum balance to earn rate. FDIC Insured for up to $250,000 and DIF Insured for over $250,000, meaning 100% of deposits are insured in full; $1 monthly fee for optional paper statements 4.10% 12/10/24 MySavingsDirect My Savings Account $0 ? N N N Y/N* - 2 max external bank links, can only push money out (no pulls) 4.10% 12/4/24 ConnectOneBank Online Savings $2500 ? ? N N Y/Y - Tiered rate: $0 - $2499 pays 0%, $2500 to $249,999 pays 4.00%, and $250,000+ pays 4.10%. 4.07% 1/25/23 Mutual One Mo Premium Savings $20k ? ? N N Y/Y - Ongoing 20k balance required to earn advertised rate. 4.01% 12/27/24 SalemFiveDirect High Yield Savings $100 $1M ? N N Y/Y - 4.01% 12/13/24 UFB Direct Portfolio Savings $1 ? ? N Y Y/Y - 4.01% 12/13/24 UFB Direct Portfolio Money Market $5,000 ? ? N Y Y/Y - $5,000 balance required to avoid $10 monthly maintenance fee. 4.00% 3/7/25 Northern Bank Direct Money Market $1 ? N Y Y Y/Y - $5k min to open but no ongoing min balance requirements 4.00% 2/21/25 Evergreen Wealth Checking $25k No Max N N N Y/Y - A deposit of $25,000 is required to open your high-yield bank accounts. This deposit opens your High Yield Checking and Savings accounts. 4.00% 2/6/25 Synchrony Bank High Yield Savings $1 ? N N N Y/Y - If your account is left with a $0 balance for greater than 60 days, it may be subject to closure. 4.00% 1/13/25 Western State Bank High Yield Money Market $1 $10M ? ? ? Y/Y - 4.00% 1/3/25 E Trade Premium Savings by Morgan Stanley Private Bank $1 ? ? ? ? Y/Y - 4.00% 1/3/25 Community Wide Federal Credit Union Hi Rate Monthly $1 ? ? N N Y/Y - Withdrawals are only allowed during first 5 days of each month. Withdrawing outside of this timeframe incurs a 15 day interest penalty. 4.00% 12/30/24 Wealthfront Cash $1 No Max ? N N Y/Y - No minimum balance requirement. Sweep account into 4 banks so up to 1M in FDIC insurance. 4.00% 12/30/24 Betterment Cash Reserve $1 ? ? ? N Y/Y - 4.00% 12/20/24 CIT Bank Savings Connect $1 No Max ? N N Y/Y - The minimum to open a Savings Connect account is $100. 4.00% 12/20/24 Dollar Savings Direct Dollar Savings Account $1 No Max N N N Y/N - 4.00% 12/20/24 EverBank Performance Money Market $100k ? ? Y Y Y/Y - Previously was TIAA Bank. Current ongoing tiered rates are: 100k+ 4.00%, 50k-99.9k 4.00%, 25k-49.9k 4.00%, 10k-24.9k 4.00%, 0-9.9k 1.00% 4.00% 11/15/24 IGObanking Money Market $25k ? N N Y Y/Y - 4.00% 11/15/24 Bank Purely Insured MoneyMarket $25k ? N N Y Y/Y Minimum $25k to open and earn interest ongoing. 3.90% 3/14/25 Elements Financial Credit Union High Yield Savings $10k No Max N N N Y/Y - Balances of 250k and above pay 3.90%. Balances 100k and 250k pay 3.80%. Balances between 50k and 100k pay 3.70%. Balances between 25k and 50k pay 3.60%. Balances between 10k and 25k pay 3.50%. Balances less than 10k pay 0.10%. 3.90% 2/6/25 Sallie Mae Money Market $1 ? N Y N Y/Y - Sallie Mae FAQs 3.90% 2/6/25 Sallie Mae High Yield Savings $1 ? N Y N Y/Y - Sallie Mae FAQs 3.90% 2/6/25 SmartyPig by Sallie Mae $1 ? N N N Y/N - 3.90% 1/24/25 Barclays Online Savings $1 No Max N N N Y/Y - 3.90% 1/3/25 iGObanking Money Market $25k ? N N Y Y/Y Minimum balance required is $25,000 to earn interest. 3.90% 1/3/25 PurelyMoneyMarket $25k ? N N Y Y/Y Minimum balance required is $25,000 to earn interest. 3.90% 12/4/24 Marcus by Goldman Sachs Savings $1 $250k N N N Y/Y - 3.90% 9/27/24 My e Banc Money Market $100k ? ? ? Y ? - Balances below 100k earn 3.40%. 3.85% 12/20/24 Quontic High Yield Savings $1 No Max ? N Y Y/Y - Minimum opening balance of $100 required. If the account is closed before interest and/or bonus is credited, accrued interest and/or bonus may be forfeited for that statement cycle. 3.75% 2/21/25 USAlliance Financial High Dividend Savings $500 ? ? ? ? ?/? - 3.75% 1/3/25 Valley Direct Savings $1 ? N N N Y/Y - Offers new customers a 4.25% rate for an unspecified period of time. 3.75% 12/27/24 Webull Cash Management $1 ? ? ? N Y/Y - 3.75% 12/19/24 Empower Personal Cash $1 No Max ? N N Y/Y - Interest begins accruing once your funds are transferred into the Program Banks, generally within 2-3 business days after a deposit is initiated. 8 Partner Banks so up to 2M in FDIC insurance. 3.70% 3/7/25 Discover Bank Savings $1 No Max N N N Y/Y - No minimum deposit 3.70% 2/20/25 American Express National Bank High Yield Savings $1 ? N N N Y/Y - - 3.70% 2/20/25 Ally Bank Money Market $1 No Max N N N Y/Y - 1099-INT online & paper, unlimited external bank links, offers 1-day ACH transfers 3.70% 2/20/25 Ally Bank Online Savings $1 No Max N N N Y/Y - 1099-INT online & paper, unlimited external bank links, offers 1-day ACH transfers 3.70% 2/6/25 Capital One 360 Performance Savings $1 ? N N N Y/Y - 3.70% 12/19/24 Citizen’s Access Savings $5,000 No Max ? N N Y/Y - 0.25% for balances under $5,000 3.61% 12/27/24 First Internet Bank Savings $100 ? ? ? ? ? - Must maintain $4,000 average daily balance to waive $5 monthly fee. Pays 4.95% with a daily balance above $1M 3.60% 1/24/25 FNBO Direct Savings $1 ? N N N Y/Y - No minimum balance requirement 3.50% 3/7/25 Emigrant Direct American Dream Savings $1 ? N N N Y/N - 3.40% 9/27/24 My e Banc Money Market $5,000 ? ? ? ? ? - Minimum opening deposit is $5,000 but no ongoing minimum balance requirement. Balances below 100k earn 3.40%. Balances above 100k earn 3.90%. 3.25% 11/10/22 Northpointe Ultimate Money Market Account $25k 3M ? N N ? - $25k min balance required to receive 2.95% interest rate 3.25% 11/10/22 Northpointe Bank Ultimate Savings $25k 3M ? ? N Y/Y - 25k minimum balance required to receive 2.95% interest rate 3.10% 3/1/23 Alliant Savings $5 N N A Y/Y - Rate requires a daily average minimum balance of $100. 3.00% 8/11/23 mph Bank High Interest Checking $1 No Max N N N Y/Y - Can earn 5.00% on up to 50k with direct deposit. 2.90% 2/6/25 PenFed Premium Online Savings $5 ? N N N Y/Y - 2.53% 8/11/23 National Cooperative Bank Impact Money Market $100 ? ? N N Y/Y - $25 monthly fee if balance falls below $5,000 2.50% 12/13/24 Varo Bank Savings $1 ? ? N N Y/Y - 2.25% 12/27/24 Paramount Bank High Interest Checking $1 ? ? Y Y Y/Y - Paramount Bank will automatically refund up to 20 (twenty) convenience fees per month. 2.10% 3/7/25 Self-Help CU Money Market $500 ? ? Y Y ?/? - $5 fee for balances less than $500 2.00% 2/21/25 ROGER Checking $1 No Max N N N Y/Y - 1.55% 9/22/22 CIT Bank Money Market Account $100 ? ? N N Y/Y - 1.50% 8/18/22 Bank 5 Connect High Interest Savings $100 No Max ? N N Y/Y - FDIC Insured for up to $250,000 and DIF Insured for over $250,000, meaning 100% of deposits are insured in full; $1 monthly fee for optional paper statements 1.10% 12/14/22 Vio Bank High Yield Online Savings $100 ? ? N N Y/Y - 1.00% 1/3/25 Community Wide Federal Credit Union Savings $1 ? ? N N Y/Y - 1.00% 9/25/22 Elements Financial Credit Union Helium Savings $2,500 No Max N N N Y/Y - 1.00% 9/22/22 CIT Bank Savings Builder $1 No Max N N N Y/Y - Requires minimum $100 deposit to open. Balance under $25,000 pays 0.40%, under $25,000 with at least $100 monthly deposit pays 1.00%, over $25,000 pays 1.00%

-

Oooh. One if my favorite threads on FW. I always read every single reply, even when I’m happy with where my funds are parked/who I’m giving a low/rock-botton interest rate loan to. Thanks for taking this on OP!

-

Alliant savings up to 1.16 today.

-

I also got the rate increase alert from Alliant although I’m juggling my funds for churning right now so I’m still earning more.

-

@jtownsucks46 Will you be copying the contents of the quick summary here? It seems like it should go in the OP since we don’t have a QS/wiki yet.

-

@fivetalents yes that’s my plan

-

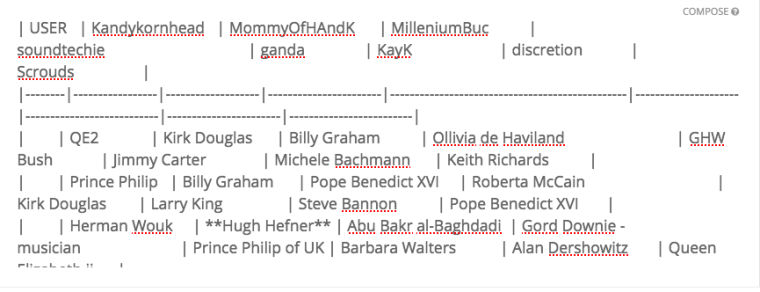

@jtownsucks46 That’s great. I tried to copy it here but it was a hot mess. @KayK seems to have mastered making tables (see here https://phatwalletforums.com/topic/273/deathwatch-2017), so I wonder if he might help. Here’s a snapshot of what he typed into the editor/text entry box:

-

@fivetalents yes, that’s why I haven’t gotten it up yet - not easy!

-

If it’s in an excel file or csv (or even fatwallet)… paste it here --> http://www.tablesgenerator.com/markdown_tables

Go to File --> Paste Data on that page and then you should get the Markdown code which you should be able to copy and paste it here. That’s what I did… copy from fatwallet, paste it there, generate markdown code, copy that, past it over here.

-

@kayk said in Best Nationally Available High APY Liquid Accounts:

If it’s in an excel file or csv (or even fatwallet)… paste it here --> http://www.tablesgenerator.com/markdown_tables

Go to File --> Paste Data on that page and then you should get the Markdown code which you should be able to copy and paste it here. That’s what I did… copy from fatwallet, paste it there, generate markdown code, copy that, past it over here.

I invoke his name and @KayK appears like a genie out of a lamp to save the day. I tested it on one of the smaller tables from the High APY QS and it seems to have worked. Thank you!

.

ETA: Table moved to the OP

-

Thanks 5T. Is there a reason Ally Bank’s 1.2% rate isn’t on the chart?

-

@orthros said in Best Nationally Available High APY Liquid Accounts:

Thanks 5T. Is there a reason Ally Bank’s 1.2% rate isn’t on the chart?

I was just testing KayK’s instructions on how to include tables with the platform used on this site. @jtownsucks46 is going to copy the entire contents of the QS here and (I presume) ensure that it is accurate/updated. But at least now, thanks to @KayK we know how to make sure the tables work.

ETA: also, if it makes a difference, the table I posted is the “Reward Checking Accounts” table, not the larger “Savings, Checking, and Money Market Accounts” table.

-

In light of the announcement of the official FW shut down date today, I’m trying to get everything in the QS transferred over to the OP, but the hyperlinks will take a bit of time.

ETA: the FW links will soon be useless so if anyone wants to preserve any of the info from them, please do so now. If you create a new thread and post the link here, I’ll update the table in the OP.

-

OK. I’m finally done importing the table and all of it’s links. Thanks again to @KayK for pointing us in the right direction.

I need folks to please test all of the links ASAP. We only have a day or two before FW goes dark to correct any errors.

The links in the FW Link column will not work soon for that same reason, so I again ask that if anyone wants to preserve any of the info from the FW links, please do so ASAP. Please create a new thread, copying the OP, QS, (except in the few cases where the link is to a single reply), and anything else you feel is critical. Then post the link here so that I, another moderator, or the OP can update the table(s). The only author of those threads that I know is a member here is @David-Scubadiver, but I invite him and the other OPs of those FW links to copy over their own threads if they want to remain the OP.

Thanks folks.

-

@fivetalents thank you - i’ll be checking links this afternoon.

-

@fivetalents said in Best Nationally Available High APY Liquid Accounts:

Scuba

No pride of ownership here. I don’t care if someone copies a thread I started and hosts it over here as their own. The only thread I remained active in was the Individual Stocks thread, and someone already started that here.

-

Greeting All. I was juuuust starting to peruse the FW Finance forums and really seeing the value in it, when Boom!, you know what happened. Thanks for providing this alternative.

I’d like to ask your all’s advice. I would like to establish and maintain an emergency account at ~$3000, with a “High APY Liquid Account” seeming to best fit the bill. Ideally, the money would just sit there, but if something came up like a broken washer and dryer, the account would fund that, then I’d top it back to $3000 as funds permitted. Non-ideally, it would be part of a job loss cushion. [My wife has an account with Edward Jones, but I’m lukewarm on that institution]. Can anyone advise how to go about finding the best account for my purposes? Thanks for helping this novice out…

-

@skaterringo I’m thinking about getting Capital One MMA. 1.2% APR and $200 sign up bonus. For < $10K its 0.6%. IDK if you’d get the sign up bonus.

-

Welcome @SkaterRingo thanks for joining us! The first post in this thread contains a list of the most recently known high APY accounts - is that what you’re asking?

-

@craig10x, @mikk1, and anyone else who was interested in/following the pagination/infinite scroll discussion, it has been moved here: https://phatwalletforums.com/topic/859/pagination-vs-infinite-scroll

-

Thanks, @mikk1 . Yes, that list is basically what I’m looking for. I take it the best way to determine which one is most suitable is just click on the ones that look most interesting and read up? As I was looking through some FW posts on the subject, I saw a wide variety of ways people used MM accounts, whereas I had assumed there was one basic purpose–simply to have liquid access to a lightly used account that gets a little more return than regular checking and the like. But I infer from your pointing me to the list that it’s not an especially complicated matter. Now I’ll take the time to look more closely. Many thanks for the convenience of the list!

-

@skaterringo If you’re just looking to simply stash some cash, yes, the list is a great start. You might also look at http://www.bankrate.com for additional listings.

Folks also use these for more complicated stuff, but I’ll let them speak into the variations if you’re looking for a more complicated strategy to maximize yields (using multiple high yield accounts with transactional requirements, etc.).

-

@skaterringo I’m not sure if it’s okay to recommend a site that provides a lot of discussions on banks including the ones that give sign up bonuses. Feel free to send me a PM so I don’t violate any rules. If the mods read this and it’s allowed, I will post it here for all to see. I can say I’ve used that site and have received thousands of $ in bank sign up bonuses juggling the same funds for DH and me for the past year.

-

@Ma-Barker

I believe you are talking about DoC.

AFAIK DoC does not use affiliate links on their site without explicitly stating so.

I think you are OK with posting links to DoC. I used to do that all the time on FW.

-

@marcopolomle yes it is Doc’s site ~ doctorofcreditdotcom

here’s a tip for those who are just starting to navigate the site:

~ for banks advertised having sign up bonuses and limited to certain states, make sure to check discussions because it has turned out that some banks do not enforce the state limitations. An example is the MandTbank which turned out a huge moneymaker to many until they closed the loophole. Bonuses posted a day or two after ACH push from an external bank posted to account. IINM, the loophole took more than half a year before it got plugged just recently. It is now considered dead but for those who live in the targeted states, make sure to check it and try your luck.

-

Where does it say SalemFive has an ACH $3 fee per transfer?

-

Discover Bank raised its rate to 1.20% on Friday 10/13. I like this because I have some money there waiting for the bonus.

-

GS Bank up to 1.3%

-

CIT Bank is now 1.35% for up to 250k, no longer has the 100k limit

-

Incredible Bank has a rate of 1.41% for balances of 250k and above

-

Ally raised its savings rate to 1.25%.

-

AAII Discover has a sign up bonus with code AAIIBONUS that expires 10/31. Current rate is 1.25%. No chexsystem pull to open this account. Bonus is $150 on $15K or more OR $200 on $20K or more deposited by Nov 15, 2017.

-

@ma-barker said in Best Nationally Available High APY Liquid Accounts:

AAII Discover has a sign up bonus with code AAIIBONUS that expires 10/31. Current rate is 1.25%. No chexsystem pull to open this account. Bonus is $150 on $15K or more OR $200 on $20K or more deposited by Nov 15, 2017.

Is this something that requires a new entry on one of the tables, or is it just an FYI?

-

@fivetalents I guess it’s both since AAII Discover savings has current APY of 1.25% PLUS the sign up bonus that expires end of October. With or without the sign up bonus, I think it’s one of the best offers around.

-

@ma-barker newbie at this stuff. I looked on the chart and didn’t see AAll Discover. Is this a Discover card product?

I’ve been thinking about getting the Capital One MMA as well. Never heard of Chexsystem. Is this like a pull when you get a credit card? Since there’s no Chexsystem pull w/ AAllDiscover does that mean I should open the Discover first then the CapitalOne? tia

-

@my4mainecoons yes, AAII savings fall under Discover Bank. It has the highest rate among three, the other two being Discover savings and AAA Discover savings although their rate is not a lot lower than AAII.

Chexsystem is usually pulled when one applies for a bank account, similar to one of the CRA when one applies for a CC. Chexsystem in NOT pulled by Discover, for whatever reasons. With the Discover savings offer, there is NO NEED to leave the money, I pulled out 98% of the $20K two days after it posted and sent it back to my external account. If the C1 bank requires you to park the funds there, I suggest you do the Disc savings first. Once you have deposited the full $15K or $20K, you can pull it the next day while leaving some amount to keep the account open until you get your bonus. Once you get your bonus, you can choose to close it, if you wish.

-

@ma-barker said in Best Nationally Available High APY Liquid Accounts:

@fivetalents I guess it’s both since AAII Discover savings has current APY of 1.25% PLUS the sign up bonus that expires end of October. With or without the sign up bonus, I think it’s one of the best offers around.

That’s what thought initially but when I tried to fill out the table I realized that most of the info needed was missing and thought I must have misunderstood. If you could provide the data points for all of the cells, I’d be happy to update the table with this new account.

-

I’d be glad to fill them if you tell me what EFF stands for and my apologies for not understanding how to fill the ACH orig/des cell is. I know what ACH push and pull is but how does the orig/des relate to opening an account? I’ll just PM you what to enter on each cell and you decide if it’s appropriate or not. If not, feel free to remove the post to avoid confusing others.

-

No need to apologize @Ma-Barker, I thought you knew this stuff better than me. I guess it’s the blind leading the blind on this one. Just give me whatever information you feel is most accurate and I’ll enter it in the table. The others can correct us or provide additional information as needed.

-

Dollar Savings Direct is now 1.50% !

-

PSA: TODAY is the last day to register for the THREE Discover savings accounts for an easy $150 OR $200 per account.

-

@ma-barker thanks for the reminder. I want to do it but am nervous. Have to deal with trick or treaters for the next few hours then will see if I can do it.

-

I can’t quote you, Ma Barker, but have a question that I could not find a conclusive answer to. Thanks to your info, my wife and I each opened a Discover savings account two weeks ago, using whatever $200 code was valid. We would like to now take advantage of the expiring AAA offer. Should we open two more accounts with our same info and deposit and deposit 20k each in the new accounts? I don’t mind doing this, but want to make sure that this give us the best chance of earning the AAA bonus in addition to the non-affiliated one.

We could also the the AAll offer, but don’t know what the requirements are. At first, I thought you had to be friend of Bill, but now think you need to be a law librarian. “smiley”

-

@honkinggoose I suggest you go to doctorofcredit website where they have the links to all three. The code I used for AAA was AAABONUS (all caps), you may be asked for your AAA membership but just leave it blank. For the AAII, they also ask for membership number which I also left blank. Code for AAII is AAIIBONUS. Even if you see the bonus code populate REMEMBER to press APPLY to make sure it gets applied to your registration. I filled in all required info for our applications to avoid missing anything. At the end, of each application the new D savings account was there. I immediately linked this to my bank hub so I can transfer money to the new account asap.

HTH.

-

@cooltech said in Best Nationally Available High APY Liquid Accounts:

Dollar Savings Direct is now 1.50% !

I updated the table, thank you.

-

@MaBarker Thank you. I did the AAA and AAII applications for both my wife and I tonight. Had to wait an hour on hold as my final application said that I needed to call. They asked security questions and wanted copy of DL / ID / Passport. She apologized for the hold time and said they were getting slammed from people trying to open the bonus accounts. She laughed when she saw all of my recently opened accounts, and without skipping a beat said that if I funded the account, I would get the bonus since I applied before 11/1.

-

Synchrony Bank’s Online High Yield Savings Account had increased to 1.30% apy on Sept 21st…

-

@interestorders said in Best Nationally Available High APY Liquid Accounts:

Incredible Bank has a rate of 1.41% for balances of 250k and above

This hasn’t been added to the table yet… is this for Incredible’s checking or savings accounts, or both?

-

CapitalOne MMA now ears 1.3% for balances over $10k (0.6% for lower balances)

https://www.capitalone.com/bank/open-an-account

-

@fivetalents Savings is 1.41% https://www.incrediblebank.com/products/savings